As you probably noticed, I was out all day. I was keeping track of things from afar but it sure doesn't look like I missed much. Don't despair. Tomorrow and Wednesday might generate a little more excitement.

Kind of like last week. I wrote up a blog post last Sunday night expecting all kinds of fireworks in the week ahead. As you know, the fireworks show eventually materialized but it took a little while to show up. Maybe this week will be the same?

You could probably tell from the tone of the previous post that I was expecting a little more downside than we saw today. However, when The Pig failed to get rolling to the upside, the metals reversed and we ended up with an uneventful day. The good thing about days like these is that they leave us with relatively well-defined ranges to watch.

Gold has now spent the better part of three trading days stuck in a $25 range bounded by 1715 on the bottom and 1740 on the top. Interestingly, I don't think that this is the real range. If gold were to break out to the UP side, it would probably be quickly stifled at 1750. If gold were to break down, significant buying should emerge at 1705. So, what we really have is a $45 range, not a $25 range, and $45 (roughly 3%) ranges are tough to break out of. Therefore, I suspect we may stick around here for a while. Additionally, OI continues to contract which leads me to think that, even though gold has rallied $200 off its lows, there still isn't much new money flowing into the pit. In fact, as of the close on Friday, total OI was just 430,159. This is down 3,550 from Thursday and it is at its lowest level since 1/17 when OI was at 425,294. And just a little OIFYI...gold is up almost $100 since then. Hmmm.

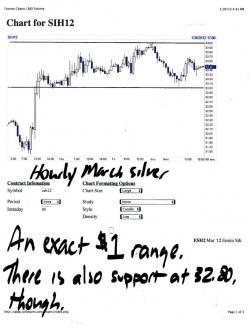

Silver has a similar picture. It is 3-day rangebound and its OI continues to contract. Friday night's OI fell to 101,885 from 102,006 and is at its lowest level of the year! All the while, silver is up about 20% on the year. Go figure! There is a mass exodus from silver by the shorts, both spec and EE. This Friday's CoT will be very, very interesting. Until then, let's see if silver can break UP and out of this current range. If it does, it will likely head to 35-35.50 pretty quickly.

Two other items before I go help MrsF with dinner. We all should be watching The Pig rather closely. I keep anticipating some headline-induced bounce but it hasn't yet materialized. Pigatha has been in this nasty down channel for two weeks now with no end in sight. We must watch 79 very closely, though. It may try to double-bottom there and then move up with an attempt to break out of the channel.

And I've noticed a few requests for a HUI chart so here you go. Rather than go small, I thought I'd give you this 2-year chart, instead. Talk about rangebound! Sheesh! The good thing is, IF it ever breaks out to the UPside, we'll sure know it. Then, you can buy miners with impunity. In the meantime, you'll have to remain picky and, to that end, I'll try to give you a complete, individual miner update later this week.

That's all for now. Hang loose, mongoose! TF