Holy Toledo! How far would the metals be down today if margins had been raised instead of lowered??

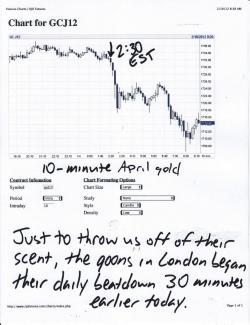

I'll try to touch upon several items this morning but I'm getting a bit of a late start so I'll try to exercise a little brevity. First up, our overnight beatdown courtesy of The Goons at The LBMA. As Ranting Andy has so diligently chronicled, The Goons like to hit gold nearly every single night at exactly 3:00 a.m. EST. This happens regularly, often 3-4 times per week and on the nights The Goons don't attack, The Monkeys on the Comex usually pick up the ball for them the next day. Sometimes, just to throw us off of their scent and, perhaps, keep us on our toes, The Goons throw us a little change-up. Last night was just such an event. Check out the chart below:

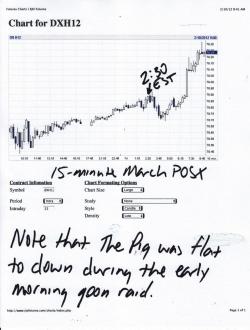

Now, maybe you're thinking to yourself: "Well, Turd, you're the one who says the ticks are being ruled right now by changes in the POSX. Did you happen to think that maybe the ongoing Pig bounce may have had something to do with this?" Oh, yah. Hadn't thought about that...

Hmmmmm. I'll just leave it there and let you draw your own conclusions.

Anyway, between the Globex attack of yesterday afternoon and the regular Goon beatdown shown above, gold found itself perched precariously near support of 1705 earlier today when The Pig shot higher on this "news":

So now The Pig is bouncing and the metals are under pressure. Frankly, I'm looking for this to continue. As this chart of The POSX shows, The Pig could easily rally a little higher from here and a further rally will only provide the impetus for The Cartels to gun the engines a bit.

I've been mentioning all week that I thought a 5% correction in gold was possible and I'm still holding out some hope. IF The Cartel can successfully break gold through 1705, they'll surely be able to trip some stops and gold will quickly fall through 1700. I expect a great buying opportunity near 1680. Not only is there technical support there, that level would also represent an almost perfect 5% correction. (1767 x .95 = 1679)

Silver remains a champ. It bounced back strongly again this morning and has been trading well on the Comex all week. This is very encouraging. Remember, we have a lot of fun with acronyms around here but the FUBM is truly a very strong technical indicator. It shows a pervasive, underlying demand that emerges in price dips brought about by EE or other selling. As you can see on the chart below, silver has incredible support between 33 and 33.20. On the 4-hour chart below, you can see that it has dipped into that range at least 15 times over the past 13 trading days. If a Pig rally can briefly drive gold below 1705, perhaps a dip in silver would develop that could take it to 32.80. Again, I hope it does because 32.80 and 1680 would certainly seem to be compelling buying opportunities.

A few odds and ends before we wrap up:

Lots of questions surrounding the timing and rationale behind the CME dropping margins on gold, silver, platinum and copper. Always remember and never forget that the CME owns the Comex and, in my opinion, they actively collude with The Cartel to suppress and manipulate the prices of paper precious metal. They are the dastardly C/C/C. Additionally, the CME has proven once and for all by their shameless handling of the MFingGlobal fiasco that their only real interest is in protecting themselves. They couldn't give a damn about investors, traders or clearing firms. All that matters to the CME is the CME's bottom line. So, ask yourself: What's in this for the CME? Why would they lower margins now? Answer those questions and you'll find your explanation for the margin drop yesterday.

If you haven't yet done so, please take the time to read the latest from Chris Martenson. At a time when fiat currencies are bouncing all over the place, this will help you to keep your "eye on the ball".

https://www.chrismartenson.com/blog/why-currency-fail/70928

Our pal, Gonzo, has written an insightful new missive. It's worth reading. Keep in mind, however, the analysis that you heard here first. Namely, that this "settlement" is nothing but covert way for the Fed to funnel money indirectly to the cash-strapped states. The states receive $26B from the TBTF banks, money that the TBTF banks will be receiving from The Fed.

https://gonzalolira.blogspot.com/2012/02/tale-of-two-settlements.html

Buried in the comments section of the previous post was this beauty by loyal Turdite, Green Lantern, who apparently doesn't sleep much. Reposted here because you should read it:

https://www.tfmetalsreport.com/comment/71908#comment-71908

It's Friday so that means we get another CoT report this afternoon. Do not look for any positive surprises again this week. For the period from the close of 1/31 to the close of 2/7 both metals were down a little in price but both metals saw their open interest expand by 2-3%. Expect to see that the bank short positions in each will have expanded while spec long increases were negated in the total by bank long closures. This would not be bullish. The action this week since Tuesday has been better and would seem to be setting up the bottoms that I am looking for early next week.

And, lastly, it has come to my attention that Judge Napolitano's program "Freedom Watch" has been canceled by Fox Business News. This is truly unfortunate. Though many will ascribe nefarious motives for the cancelation, in TV it's all about the ratings. If a network thinks they can get higher ratings with something new and subsequently fleece their advertisers for more dollars, they're going to cut and move on every time. It would still be worth your time to support The Judge, however. Apparently this woman, Irena Briganti, is the one responsible for making the programming decisions at FBN. I've already sent her an email, politely asking her to reconsider her decision. If you'd like to do the same, her address is:

irena[dot]briganti[at]foxnews[dot]com

On the bright side, I've been trying to track down The Judge for weeks, hoping to secure a podcast with him. Maybe now he has a little more free time, I'll finally get it done.

OK, that's all for now. Hang in there and be sure to keep some dry powder for early next week. TF