As you know, I'm very excited about the prospects for the fiat-conversion price of silver this year. It's going to a big year, perhaps even historic. That does not mean, however, that silver will move in a straight line up. I still believe the The Evil Empire intends to dramatically lessen, if not eliminate, their long-time manipulative short position. However, a careful review of the situation at ground level leads me to think that we're not out of the woods yet.

As you know, silver has already had a big 2012. Silver closed on 12/30/11 at $27.92/ounce. It closed yesterday at $33.60. In just six weeks, this means silver is already UP over 20%. Spectacular! At this rate, silver would be $40 by April 1st, $57 by mid-summer, $83 by fall and $120 by year end. Now, of course, the prospect of $120 silver makes you and I very excited. Jamie, Blythe and Ruprecht...not so much.

So, what's The Empire to do? Last spring, it became clear to them that manipulating silver was no longer a game they should be playing. Global quantitative easing and soaring physical demand stacks the deck against them and they want out. Of course, this is much easier said than done. Last year at this time, the total bank short position was around 90,000 contracts. In a market the size of silver, you don't simply flip the switch and cover a position like that in a matter of weeks. To do so would be foolish and incredibly expensive. No, care had to be taken to eliminate the position with as little loss as possible.

At first, The EE went headlong into covering and this sent silver soaring. In the last week of April, as silver was trading up every single day, The Forces of Darkness covered nearly 10% of their total short position while simultaneously adding about 2000 longs. They were panicking and price was skyrocketing. Clearly, this strategy wasn't working and, instead, on April 30th, The EE switched course and forced the first of two, incredible 35% prices smashes. Covering into weakness instead of strength allowed The Empire to reduce their total short position to just 55,000 by year end. They were also able to raise their total long position to 41,000, up from 34,000 in April, thereby bringing their net short ratio all the way down to 1.3:1, down from its high of nearly 3:1 during the panic in April. All the while, price had fallen from $48 to $28. Absolutely spectacular and worthy of a round of applause, a pat on the back and huge year-end bonuses for The Wicked Witch and her Monkeys.

On 1/1/12, everything looked great for The EE but, suddenly, a change took place. Silver, instead of continuing to languish, exploded on two fundamental positives. First, the announcement of a $350M purchase by PSLV. Hot on the heels of that was The Fed pronouncement that QE would, in fact, continue on to infinity and it was this Fed development that spooked the EE the most.

We know via CoT data that, as of 1/24/12, the total bank long position was 35,283, up just 1,000 contracts in 2012. The total bank short position was 60,304, up nearly 10% in 2012, a moved designed to keep things in check a while longer. On the evening of Tuesday 1/24, silver was priced at $31.98, already up 14.5% on the year.

The next day, The Bernank dropped the bomb. Continued ZIRP and 0% Fed Funds ensured negative real rates until at least 2014 and, as we all know, negative real rates are fundamentally positive for the PMs.

https://www.tfmetalsreport.com/blog/3325/case-you-missed-it

Prices jumped. On Wednesday the 25th, gold rallied $36 to $1703 and silver added $1.14 to $33.12. In the 12 trading days since, though, gold has only managed to add $22 and silver has tacked on just $0.48. What's the deal? Conveniently, and certainly not intentionally, the Fed's announcement came on a Wednesday, the first day of a new CoT survey week. What's great about this is that we're able to see a direct cause-and-effect in the numbers. Please bear with me and check out the raw data:

Spec Long EE Long EE Short EE Net Ratio:

1/24/11 27,051 35,283 60,304 1.7:1

1/31/11 28,465 (+5.23%) 33,693 (-4.51%) 62,422 (+3.51%) 1.85:1

2/7/11 32,239 (+13.3%) 31,795 (-5.63%) 66,445 (+6.44%) 2.09:1

So, in the two weeks immediately following Uncle Ben's announcements, the total Spec Long position has risen by 19.18% while the total EE Long position has fallen by 9.88%. The total EE Short position has also risen by 10.18%. Hmmmm. Does this explain for you how silver has been kept under $34?

In the end, what does this mean? Though I firmly believe that The Forces of Darkness have every intention of effectively exiting the silver market in 2012, they are intent upon not allowing a repeat of spring 2011. To that end, they're keeping prices in check here, hoping to draw in some new longs that they can exploit to the downside. Was the CME margin drop this week one of the tools they intend to use to accomplish this? Maybe, but whatever it is, it's working. A 13% rise in spec longs in just two weeks is significant and you can bet that soon the EE will attempt to force that money back out.

What will be our clue that this next smashdown is near? Perhaps the answer can be found in silver lease rates. As you all know, we correctly "put the pieces together" and foresaw the gold smashdown in December that was preceded by a steep drop in gold lease rates. Could silver lease rates present the same clues? It would seem so. Take a look at these two charts:

As you know, in the last 4 months of 2011, silver was raided twice. Note that in the days before each raid, 1-month silver lease rates declined below -0.40%. Rates reached a bottom on 9/12/11 and silver fell sharply just a week later. Rates bottomed on 12/6/11 and, once again, silver was raided within a few days. After turning positive in early January, silver lease rates have again turned and the 1-month rate this morning is -0.30%.

It is very important to note that -0.30% does not seem to be a low enough rate to give a 100% certain sell signal...but it's close...and we must diligently watch the daily changes to this rate in the days ahead.

A drop of another 10 basis points would cause me to exit any long positions I have and I would probably even buy some puts. A drop of 10 basis points from here should cause anyone not trading to at least consider establishing some short-term, hedge positions. A move to -0.40% or lower should excite the stackers and give them time to cobble together more fiat to take advantage of the "sale" that would seemingly be near.

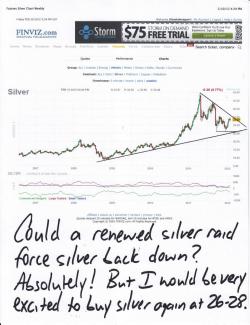

How far could silver fall? Take a look at the chart below and decide for yourself. $31 would be likely. $28 is a possibility but, with a little luck, we could even see $26 again.

Notice that I used the term "with a little luck". IF we were to see sub-$28 silver again, I would consider it to be one of the greatest trading opportunities of all time. I'm not sure it can get there, though. Even if every single new spec long was panicked back out, I don't think that would generate enough selling pressure to jam silver that far down. The EE would definitely need a huge increase in the spec short position and it's hard to see that happening. Maybe...but it would be tough. It's likely that the only way we'd see $26 again would be a panic, one-day spike down like we saw in September and December.

One word here about gold and gold lease rates. The one-month rate in gold, while negative, is not even close to the levels to which it fell in September and December. We'll watch it, of course, but a sustained raid in gold does not appear imminent.

So, let's sum up:

- I firmly believe that The EE wants to be net neutral in silver by the end of 2012.

- The EE must accomplish this in stages, however, as they do not want a repeat of April 2011.

- Silver was moving too far, too fast in January and the EE has decided to corral it.

- Spec longs are up over 13% in the past two weeks while the EE has gotten significantly more negative.

- Silver is stable here and may still drift higher but a further drop in one-month lease rates may foretell a renewed attempt by The Forces of Darkness to smash prices lower.

- Another, coordinated silver raid could temporarily drive prices back under $30.

- $30 silver should be bought hand-over-fist.

I, your humble servant, will continue to closely monitor these developments.

You, the loyal Turdite, must continue to monitor this site and prepare accordingly.

TF