Priced in Gold

I've been looking at something for a few months now, I wondered if anyone had any thoughts.

First, let's look at the S&P 500 daily chart. It's just kind of all over the place, hovering around the 50 day moving average, it bounced off the 200 a couple times:

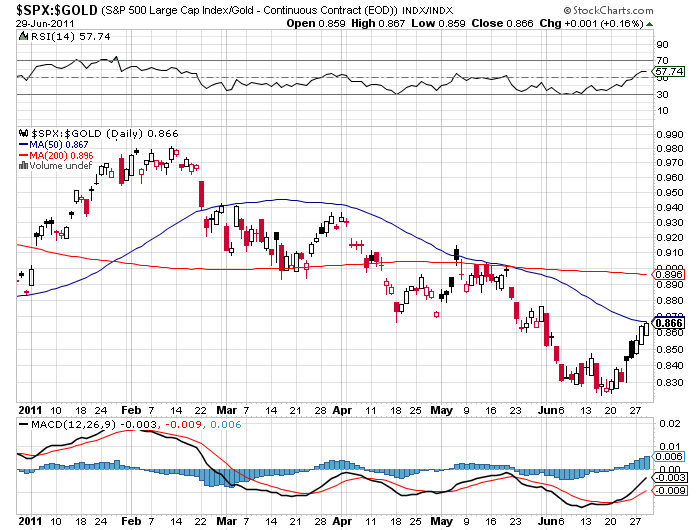

Now, what if the S&P was priced in Gold rather than US Dollars:

The 50 day MA has given very strong resistance, and there has been very strong resistance both ways when crossing the 200. The "death cross" when the 50 moved below the 200 in May was drawn out for nearly the whole month.

It hit the 50 today, it will be interesting to see if it breaks it or not.

I think the point here is, the US dollar is completely meaningless for pricing things, and I'm wondering how much that throws off any analysis.