The term applies in several contexts today. First, we are finally seeing resolution of the manufactured decline and bottom that began a year ago in silver and nearly eight months ago in gold. More importantly, however, the title applies to our own resolve as we summon the courage to stand with conviction as we face this final onslaught.

Trading and stacking has never been, and never will be, easy. You see, my friend, you and I are financial outliers. We see the truth behind the lies. We are aware of what is coming and we are trying to prepare. Because this notion flies in the face of the conventional and because the involuntary reaction of those whose normalcy bias is threatened is ridicule, you and I are often maligned as "conspiracy theorists" and "bugs". This is fine and we all laugh along when times are good and PM prices are rolling higher. On days like today, however, the tin-foil hat starts to get a little itchy.

So, what are you going to do? Do you have conviction? Are you resolute in your beliefs or are you simply a bandwagon-jumper, ready to run back to the "safety" of AAPL, Vanguard and a CD?

The world, as we've known it, has ended. A global financial tectonic shift has been underway now for over three years. There is no going back just as there is no stopping it. Now, you have a choice to make. You can continue on this path toward personal, financial protection or you can melt back into the herd. I, for one, will stand my ground. I know that I am right and I will not genuflect at the altar of the status quo.

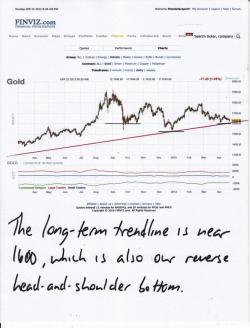

Gold near $1600 is an extraordinarily attractive offer. After the Cartel Panic of last August, the paper price has been raided, suppressed and capped while physical demand caught up. We now stand at a point where gold has traced out a massive, 7-month reverse head-and-shoulder bottom. Additionally, at this price, we're told of significant sovereign and central bank demand for physical delivery. Where these two points meet represents the extraordinary opportunity to trade or stack. That point is right here, right now. Between 1595 and 1610, lies the final bottom to this brutal "correction". Gold will have retraced all the way back to where it was before the "debt ceiling debate" and subsequent S&P downgrade last July and August. Do you think this is coincidence? It's not. $1595-1610 is your floor.

Silver is also very near an historic bottom. Somewhere near $30 would represent a nice, symmetrical reverse head-and-shoulder bottom and it certainly looks like that's where we're headed. Take a close look at this first chart. After "Theft #1" last May, price double-bottomed near $33 and then rallied into "Theft #2" last September. Note that, again, price double-bottomed, this time near $26.

If this was the only chart we had, we would all have to be nervous about a pending "Theft #3". However, a quick look at the weekly chart and you'll see other details emerge. Note that there's not just a double-bottom at $26, it's a triple-bottom with the lows back in late January 2011 (Turd's Bottom). Note, also, the convergence of the primary, long-term trendline with these bottoms and the pending conclusion of the long-term, "wedge" pattern. So, let's sum up silver this way:

- Could $30 silver be the final bottom of this year-long correction? Yes.

- Could silver trade below $30? Yes.

- Could silver continue sideways within the wedge for another 60-90 days? Yes.

- Could silver briefly trade all the way down to $28. Yes.

- Will silver trade down through $26. No.

- Is this the time to give up? No.

- Is it time to sell your stack? No.

- In the end, will The Forces of Darkness prevail? No.

I leave you today with a few lines from the American patriot, Thomas Paine. At the bleakest hour of the American Revolution, Paine wrote the first missive of a series which he titled "The Crisis". America had begun its war of revolution in the warm days of summer six months earlier when 56 men mutually pledged their lives, their fortunes and their honor. After a six-month "correction", all was on the verge of being lost. The Continental Army was subject to de-enlistment and deserters. Morale was low. To some, defeat seemed inevitable. On a much smaller scale, we in Turdville stand at a similar point today. You are being tested. You must be strong. You must be resolute. You must have the courage of your conviction.

Stand with me. We will prevail. TF

These are the times that try men's souls. The summer soldier and the sunshine patriot will, in this crisis, shrink from the service of their country; but he that stands by it now, deserves the love and thanks of man and woman. Tyranny, like hell, is not easily conquered; yet we have this consolation with us, that the harder the conflict, the more glorious the triumph. What we obtain too cheap, we esteem too lightly: it is dearness only that gives every thing its value.

I thank God, that I fear not. I see no real cause for fear. I know our situation well, and can see the way out of it. This is our situation, and who will may know it. By perseverance and fortitude we have the prospect of a glorious issue; by cowardice and submission, the sad choice of a variety of evils — a ravaged country — a depopulated city — habitations without safety, and slavery without hope — our homes turned into barracks and bawdy-houses for Hessians, and a future race to provide for, whose fathers we shall doubt of. Look on this picture and weep over it! and if there yet remains one thoughtless wretch who believes it not, let him suffer it unlamented.