It's beginning to look a lot like 2008. Everywhere you go. Selling anything you can find, can ease your liquidity bind. From gold to stocks to crude and the eur-oh.

Wow! Does anyone else have deja vu, all over again? If it isn't nailed down, it's getting thrown out today. We're either at the end of this liquidation cycle/event or we're just at the beginning. Time will tell, I guess. I mean, for crying out loud, look at the euro. It's right at the lows of 2008 and just points away from the lows of early 2010.

Crude, too. Just nasty. Events in the MENA be damned, just sell Mortimer, Sell!

And, of course, this is all spilling over onto the gold and silver servers and motherboards pits. If it has a bid, sell it for pete's sake. While you still can! Regardless that The Great Reset is fast approaching. It's of little consequence that gold and silver will soon be revalued multiples higher. I need cash NOW! Sell Mortimer, SELL!

And, of course, in the background, just whom do you think is buying?? Never forget that for every seller, there is a buyer. Who might that be??

And I hope you're not expecting all of this to calm down anytime soon. Today is the last trading day of the June12 gold contract, also known as First Notice Day. As you've learned, FNDs are almost always DOWN days as The Cartels are wont to dissuade as many as possible from standing for delivery.

And I hope you realize that Friday is another BLSBS day. Surprising that it's on the 1st day of the month. I'd have expected it to be next Friday but it's not. It's this Friday. Two days from now. As you've learned, the metals are almost always sold off prior to and just-following the release of that monthly make-believe.

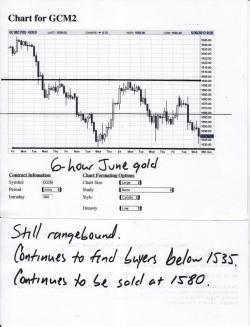

So, here are your charts. The GOOD NEWS is that buyers continue to emerge near $1535 in gold and near/above $27 in silver. The longer these levels can hold, the more the downward momentum will wane and, eventually, we might break out of the range to the UPside. Additionally, you should note that this is the third, consecutive Tuesday-Wednesday that saw the lows of the week in the early trading hours of Wednesday. Not coincidentally, those lows keep occurring near the $1535 and $27 levels. Let's see if another bounce will develop today.

Just a couple of other items for you today. First, I wonder what that old greaseball Buffett and his pal The Bernank think of this. What a strange new use for an otherwise barbaric and worthless relic ( https://www.telegraph.co.uk/finance/financialcrisis/9298180/Europes-debtors-must-pawn-their-gold-for-Eurobond-Redemption.html)

And this is fun. Part 2 of a 3-part series from our pal Jeff in Canada. ( https://www.bullionbullscanada.com/gold-commentary/25549-the-three-trends-which-rule-the-precious-metals-market-part-ii)

Lastly, our new buddy John Butler was on RT with The Lovely Lauren yesterday. I would imagine that John found this particular interview to be considerably more stimulating than the one he conducted with me back on Friday.

Alright, that's it for now. Have a fun day but beware the volatility and keep your eyes on the prize. I, for one, am going to post this note and head off to buy some more phyz. This time I'm thinking some 5-oz silver bars. We'll see. More later. TF