Today's action, though disappointing, is meaningless when next week brings another FOMC meeting and the BLSBS. I hope you're ready.

Frankly, my biggest concern is that we've seen this all before. The Cartel allows the metals to rise in the days before some kind of Fed "news", only to rip the spec's guts out when the Fed, inevitably, disappoints. So, the most likely outcome next week is a rally on Monday and Tuesday as the Spec Sheep are led into the shearing barn.

The hammer falls on Wednesday and Thursday as the politically-handcuffed Fed "disappoints".

Then, a sharp rally on Friday when the BLSBS comes in lousy.

The Spec Sheep get sheared twice by being long on Wednesday and short on Friday. The Gold Cartel wins twice and laughs all the way to the bank.

{Now, let's get one thing straight. I am NOT trying to have it both ways. What I have described above is the most likely outcome for next week. Likely but not 100% certain. Regardless of what happens next week, I am still expecting a hot, explosive and historic summer and fall.}

OK, let's just wrap up some charts before we get to the weekend. First, The Pig. Where all looked strong earlier this week, the bluster regarding QEIII has buckled its knees, somewhat. It is still well within the channel that has driven it higher since late last year but, with all this talk of easing, it must be watched closely.

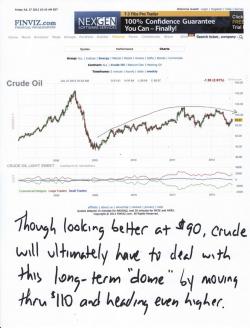

And a small note of caution in crude, too. In the short term, it looks fine as the more time it spends above 88-90, the more likely it looks to go tackle 93 and head toward 100. All crude traders most be cognizant, though, of this long term "dome" pattern. IF crude can continue to rally, it will eventually have to trade through 105-110 or it risks perpetuating this pattern and falling back.

And here are your daily charts for both gold and silver. Both look pretty good, actually. As you can plainly see, gold has broken free of the pennant formed by the Feb 29 highs and the May 16 lows. This is great but it is only step 1. For the remainder of the "steps to recovery", please read the text on the chart. In silver, we are still penned under the "Battle Royale" line. Do you recall that, back in late February, the line was near $36? Now, with the passage of time, it has fallen all the way to $29. This pattern must resolve itself in the next 6 weeks or so but I have a strong hunch that silver will break out and through well before then.

This week's CoT will be somewhat interesting. For the reporting week, gold was down $13 and total OI was also down by 11,000 contracts as August contracts were not immediately rolled into Oct or Dec. Silver was down 52c while total OI rose by 1800. Someone was busy creating new silver shorts at these levels. Was it the SSS (SpecShortSheep) or was it JPM? The CoT will provide some answers so please check back later this afternoon and search the comments section of this thread for my analysis.

Have a great weekend. Try to relax and have some fun. Next week promises to be exciting!

TF