The fun starts tomorrow with ECB news and the ADP numbers. Then it really gets going with the BLSBS on Friday. For today, however, it's a narcoleptic paradise.

It seems no one, including The Bad Guys, is ready to make any substantial bets ahead of The Drama. So, here we sit. As you can see below, both metals are trading in a pretty tight range. I would expect this to continue today with any rallies being capped and any selloffs being bought.

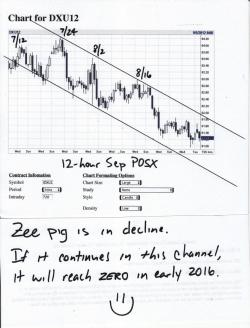

The Pig squealed a bit yesterday bit has since fallen right back toward the 81.20 support/resistance line. Like the metals, I wouldn't expect much substantial movement until tomorrow.

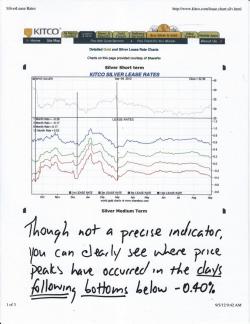

Lots of talk recently about the declining lease rates for silver. Today is such a dull day that it seems a good time to discuss them. There are a couple of things you need to know:

- I feel that gold lease rates plunges are a more reliable "raid predictor" than silver lease rates.

- Short-term gold lease rates remain steady around -0.10%, where they've been for the past 5 months.

- However, on three separate occasions over the past 12 months, you can clearly see where a bottom in lease rates below -0.40% has preceded a short-term top in silver.

Taking this into account, lease rates by themselves are not a reason to lighten positions but they are definitely something you should be checking from time to time.

And I think I finally understand why Nadler is such a first class deltabravo all of the time. It's pent-up, sexual frustration. He knows that a FOAD such as himself has zero chance with hot chicks and, consequently, seeing the Sensual Temptress Daniela roaming the halls every day must drive him crazy! Below is a link where the sultry Ms. Cambone interviews The Great Bill Murphy. Not a lot of new material here. Just a very nice distraction on this very dull day.

https://www.kitco.com/KitcoNewsVideo/

Not nearly as exciting but worth the two minutes is this CNBS sketch with Jimmy Rogers:

https://video.cnbc.com/gallery/?video=3000110915&play=1

Here's your daily debka update on the impending MENA disaster:

And, lastly, have you checked out the Baltic Dry Index lately? We were watching it closely earlier this year as it collapsed to multi-year lows near 650. Surprisingly, it then surged back to 1100+ in May and July. Since then, it has collapsed again and currently sits at 698. Sort of like lease rates, the BDI is not some kind of be-all-end-all predictor of future events. It does, however, have significance and it needs to be monitored.

https://www.bloomberg.com/quote/BDIY:IND

That's it. That's all for now. I'll update later if anything exciting happens. Until then, I'll just be sitting here, watching that kitco clip over and over.

TF