While it seems that "everybody and their brother" is now expecting a sharp pullback, I'm not on that bandwagon.

Please don't accuse me of having my head in the sand. I mean, seriously, if anyone knows about The Cartels, the CoTs, the charts and the lease rates...it's me. I know all about it and you, as a Turdite, likely learned a few things from me. And who knows, maybe all this short-term bearishness will turn into a sort of self-fulfilling prophecy? If enough people pull their bids (especially for physical) because they expect a pullback, a pullback will then develop. However, there's also potential for quite a few people to get caught flat-footed and if a breakout rally develops, many will be left chasing.

Again, what I see is this:

- As stated here often as of late, all reports are that physical demand in London remains robust, regardless of dips or rallies in paper price

- Gold priced in euro and Swissie just made new all-time highs last week and have been preceding gold priced in dollars by about 4-6 weeks.

- The desperate move by The Cartels, particularly JPM in silver, to add shorts and contain price creates a condition of extreme UPside potential if longs don't capitulate and are, instead, emboldened.

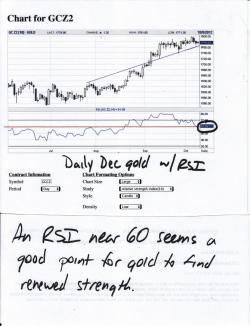

- RSI levels in both gold and silver have worked off excesses built up during the 4-week rally from mid-August to mid-September.

- The silver smash of 5/11 and the gold smash of 9/11 both came during periods of ending or non-existent QE. The Fed just announced QE∞ last month and those $ are just beginning to slosh around. Give it time. Additionally, QE∞ only adds to and increases global demand to exchange fiat for hard assets.

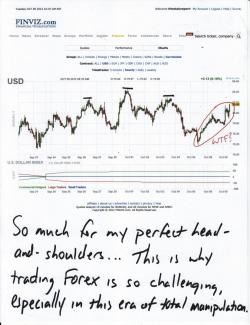

So, call me crazy but I'm a contrarian here. (Even though, as I type, I see gold being smashed down to 1766 and silver well under $34.) The dollar has rallied and reversed from its head-and-shoulder top of last week. This has surprised many (including me). The algos then use this $ strength to game the metals and any weak hands with sell-stops. The Forces of Darkness might throw on some new shorts, too. Again, though, I do not expect any serious downside momentum to develop. I suppose you could get a dip toward $1750 but that's about it. As long as the QE∞-inspired physcial demand remains strong, prices will ultimately reverse and head back higher.

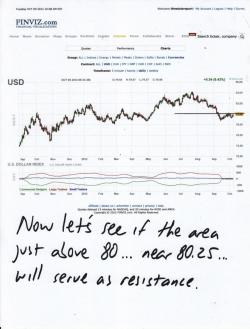

Anyway, here are two charts of The Pig showing the surprise reversal:

Here are some gold and silver charts that, because of this current raid, seem a bit obsolete. Oh well, I'm posting them anyway. Take them for what they're worth.

And here are daily charts with RSIs printed below. Most of the "overboughtness" has been worked off and this current selloff has only served to work off even more.

And a just a few words about crude, too. The chart below certainly doesn't look too scary but, if I were short, I'd sure be nervous about a move back up through $92 and then $93. Especially after reviewing headlines like these: https://www.zerohedge.com/news/2012-10-09/turkey-deploys-25-f-16s-syria-border & https://www.debka.com/article/22422/US-sources-US-Israel-plan-October-Surprise-Others-Israel-can-do-it-alone

So, I'm going to go ahead and hit send on this post, even though I currently look rather foolish with gold down $14 and silver at $33.60. By later today, I could be completely wrong and maybe the newsletters writers will have been proven correct. We'll see. But this is my story and I'm sticking to it. C'mon, baby! Daddy needs an FUBM!!

Have a great day!

TF