Time to bust out this sorry-looking SOB again.

I wasn't planning on writing anything today but then it dawned on me:

- After yesterday, everyone needs a subtle reminder that all is not lost.

- Many folks come and go all week and may have missed the general theme.

Once again, my time is short so I'll keep it simple and to the point. This current pullback/correction is nearly identical in circumstance to the pullback of January 2011. Back then, QE2 had been announced seven weeks earlier and, once the initial, euphoric push into the metals had subsided, priced were raided in order to give The Cartels time to cover some shorts. Both metals saw all of their post-QE gains clawed back over a three-week period. Desperation was in the air. The MOPE was thick with misleading economic statistics and pundits everywhere were proclaiming the death of the metal bull market.

I lived through it and wrote about it on the old "Watchtower" site . Here's a sample of the mood and tone from that period: https://tfmetalsreport.blogspot.com/2011/01/darkest-before-dawn.html

Finally, after three weeks of nonsense, I was fed up by the discongruent action and issued this guarantee. Old-timers will recall it as "Turd's Bottom": https://tfmetalsreport.blogspot.com/2011/01/1600-gold-by-june-10-2011.html

This week, we reached the same place. If you haven't yet reviewed this post from Wednesday, I urge you to take the time to do it now: https://www.tfmetalsreport.com/blog/4265/tempest

Look, I really don't care what anyone else says. The chartreaders and the subscription guys can all kiss my skinny, Cornhusker rear end. As Hans and Franz would say, "Listen to me now and hear me later!"

THIS IS ALMOST OVER. SOON, THE METALS WILL REVERSE AND HEAD MUCH, MUCH HIGHER. PLEASE USE THIS TIME TO ACCUMULATE AND/OR STACK. YOU WILL BE HANDSOMELY REWARDED IN THE SHORT TERM WHILE YOU PREPARE FOR THE LONG-TERM.

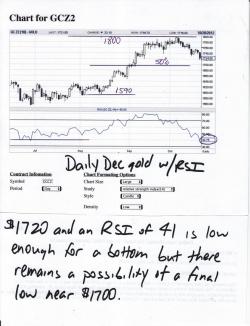

As you can see below, both metals have nearly completed a perfect, 50% retracement of the rally from mid-August to early October. Note, too, that Relative Strength Indicies have subsequently fallen to levels from which rallies typically begin.

What happens next is easily predictable. I mean, I could be wrong but I doubt it.

With silver below its 50-day MA and gold sitting directly upon its, expect more weakness Sunday night into Monday. As gold slips below $1720, more momo-chasers will enter on the short side and gold will likely fall even further. I'd expect a low somewhere around $1700 + 10. Silver will fall toward $31.50, maybe even $31 if it really gets ugly.

At this point, all of the remaining spec short sheep will have been drawn into the trade and the metals will reverse, probably by late Monday or overnight Tuesday. The metals then may hang around in a choppy trade for a few days as they build a base and a bottom. Here's another sample from 2011, this one written on 2/1/11, seven trading days after the guarantee of "Turd's Bottom": https://tfmetalsreport.blogspot.com/2011/02/battle-rages.html. Note that the base-building process off of this type of correction can be strenuous as the shorts try every trick in the book to regain their momentum.

Finally, based upon extraordinary fundamentals and overwhelming physical demand, the metals will charge higher once again, eclipsing $36 and $1800 on the way back to the levels last seen in the spring and summer of 2011. This will happen. Just be patient and keep the faith. Relax and continue stacking.

Have a great weekend!

TF