After the fireworks and short squeeze of Friday, the churning trade of today shouldn't surprise anyone. It's a safe bet to expect more of the same tomorrow, too. Maybe even the rest of this week. We'll see. The start of December, however, should certainly bring more excitement.

Until then, we wait. Yes, it was fun to see the pop back on Friday. I was able to use the rally to finally lighten some of my December option positions and I will use any pullback this week to roll into March silver. But, as the opening paragraph states, I'm not expecting much of a sustainable move, one way or the other, this week. The Dec12 gold options and the Dec12 silver options all expire at the Comex close tomorrow. Until then, expect the HFTs and The Cartels to jam price back and forth in an attempt to shear as much fleece from the sheep as possible. Then, on Friday, we have First Notice Day for both contracts. (Remember that FND is the "put up or shut up" day for futures contract holders. By the close Friday, you either have to sell your Dec contract or express your intent to take delivery by placing 100% margin into your account.) Always fearing a delivery crisis, The Gold and Silver Cartels will likely instigate some price weakness in order to discourage anyone considering delivery from actually doing it. Think The Godfather and the horse head in the bed.

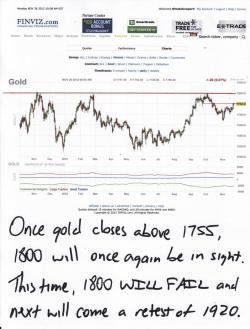

So we're left with a rangebound trade for now. Gold rallied Friday right up to the final resistance line of $1755. We identified that area a few weeks ago as the final stopping point before the next test of the Cartel Maginot Line at $1800. We may not close through $1755 until next week. We may close through there tomorrow. Heck, I don't know. What I do know is this: Gold WILL close through there soon and then it will make another move toward $1800. In December, $1800 will fail and, in early 2013, the stage will be set for a move back to the old alltime highs. There you can expect serious Cartel resistance as their only hope will be to attempt to paint a double top.

Silver is will likely be contained below $35 this week with the option expiration and FND. Next week should be a different story, however, and it will also trade higher in December. I expect the cap/ceiling of $35.50-36.00 to fail this time and The Forces of Darkness will be forced to fall back to the $37-38 area. Sometime in December, they'll fail to hold that area, too, and we'll begin our ascent toward $44.

Dr. Dave Janda kindly invited me onto his radio program yesterday. It was an honor to speak with him and we covered many of the topics near and dear to the hearts of Turdville. Below is a link to the audio. If you don't have time for the entire thing, you should at least be sure to FF to the 16:00 minute mark where Dave plays some audio from Thunderlips that was recorded over two years ago. You'd swear it was recorded last week, instead. What a massive con and charade the CFTC is promulgating. Yuck.

https://www.davejanda.com/operation_freedom/

https://www.davejanda.com/audio/TurdFerguson112512.mp3

And, finally, today is Cyber Monday!! Please don't forget to visit the TurdMart for all of your holiday shopping needs. Who on your list wouldn't love a TFMR t-shirt?? Seriously...a true gift of distinction! All genuine and authentic Turd merchandise can be found by clicking here: https://www.tfmetalsreport.com/store. Please remember that the site benefits if you are directed to Amazon, too. Any purchase you make at Amazon after arriving there via links from TFMR generates a small commission for little ole Turd.

So, anyway, that's all for today. Go and be happy. Be confident, too. December is going to be a very exciting month and 2013 will truly be historic. Have a great day!

TF