When both Andrew Maguire and Ted Butler write about the same thing over weekend, one should probably sit up and take notice.

In this case, what they were discussing was a possible, end-game scenario for the silver manipulation. The commercial short position has grown so extreme AND the physical supply has grown so tight that, suddenly, these two great minds were exploring the available options for JPM et al as they attempt to extricate themselves from what is growing into an unmanageable and untenable position.

Andy commented that in his "thirty years of experience, he'd never seen a more dangerous situation developing" and that, soon, the only possible way out would be a "back door solution". This "almost certain" resolution would hinge upon the cash settlement of futures contracts that would position paper traders on the sidelines before the "gap higher" next trading day in the new, physical market.

Andy's commentary had already roused my attention and then I read Uncle Ted's weekly review. In it, he discusses the "Maine Potato Default" of 1976. First of all, here are two links that can provide some background for you: https://www.time.com/time/magazine/article/0,9171,947729,00.html & https://news.google.com/newspapers?nid=1988&dat=19760526&id=a2YiAAAAIBAJ&sjid=06wFAAAAIBAJ&pg=1377,2637833

Here's the introductory paragraph of Ted's analysis:

"Since the problem is JPMorgan’s 38,000 contract net short position in COMEX silver, that problem will disappear if the regulators, as is within their powers, decree that a market emergency exists and orders all silver contracts to be unilaterally closed out and settled at an arbitrary price. In an instant, JPMorgan will be let off the hook and the problem, from a regulatory perspective, will exist no more. Yes, it would represent a contract and market default and reflect badly on the regulators, but it would resolve the extreme market structure issue immediately. Further, this is not a resolution that would be without precedent. Almost 40 years ago, the predecessor of the NYMEX defaulted on their important Maine Potato contract because the largest short seller, the late J.R. Simplot, couldn’t deliver as promised. All open contracts were artificially closed out at a set price and that was it. Yes, it was a scandal and a black eye on the world of commodity trading, but not one in ten million even remembers it today. The scandal led to a cessation in the trading of Maine Potato futures and a similar COMEX forced settlement today most likely would lead to the termination of silver futures trading in the US. One could argue that silver trading today is more important than potato trading was in the 1970’s, but my point is that to the average citizen, a COMEX silver shutdown would be forgotten in time and life would go on." Subscribe and read more at: https://www.butlerresearch.com

So why do I bring this up? A number of reasons.

- We KNOW that this silver manipulation cannot go on forever. In fact, the increasing physical supply tightness makes this eventuality a possible near-term event.

- A Comex/CME cash settlement screw job would not be surprising at all. If you don't believe me, ask anyone who had an account with MFGlobal for their opinion.

- Though painful to the short-term reputation of the Comex, the CME and the Silver Cartel (mainly JPM), the event would barely register in the financial press and would soon be forgotten. If you don't believe me, ask yourself the last time you saw a headline on the LIEBOR Scandal.

- Though there would likely be a significant runup in paper price and other warning signs of this impending "default", paper traders had better be fully aware of this possibility/probability.

- The Maine Potato Default of 1976 clearly shows that there is precedent for this kind of event.

- In this scenario, holders of all types of paper silver (futures contracts, paper certificates for physical, ETFs) will cash settled and be left on the sidelines, holding the bag, out of the market and unable to participate in the next-day reset in price.

Once again, your only solution is the purchase and delivery of physical metal. Period. End of story. Yes, it's fun to trade and the leverage applied may allow you to increase the stack of your fiat. However, there is no substitute for physical metal. Holding physical metal is not just the only way you are guaranteed to participate when the Silver Scheme finally unravels, it is also your only protection against the other financial calamities that are just around the corner.

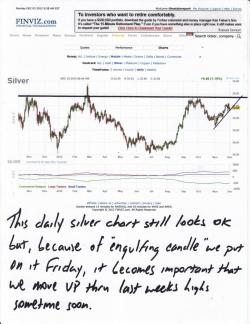

It's nice to see a bounceback in price this morning, though we are clearly seeing some continued volatility. I expect our support levels to continue to hold and I expect a "Happy Tuesday" rally tomorrow as the banks will want to cover some of last week's shorts ahead of the CoT survey. Both charts got painted with ugly, engulfing candles back on Friday so we need to see a rally this week in order to invalidate them and discourage some momo-chasers from piling in. Rest assured, though, I still expect December to be a solidly bullish month that will set the stage for a powerful 2013.

Lastly, just another reminder of the free webinar on Wednesday. It's scheduled for noon EST and will last 15-25 minutes. It will begin with a brief commentary from Andrew Maguire. He'll discuss the metals markets and the increasing role that the HFTs are playing. Then, Paul Coghlan will give a presentation of his technical analysis methods. This will be extremely valuable information so I strongly encourage you to listen in. The entire presentation will also be recorded for playback by those who are unable to listen live. To access it, though, you must pre-register. You can do so by clicking here: https://www1.gotomeeting.com/register/240678176

OK, that's it for now. I hope everyone has a great Monday!

TF