What a day, huh? First we saw some May silver call-sellers get squeezed. Then, the FOMC statement caused a sharp selloff. Unfortunately for The Cartel, no waterfall ensued as price quickly rebounded. We now look to be on the verge of a rally. Let's get started!

I know that many folks come here only to read my blogs or to visit Pailin's Corner. In doing so, many miss out on the terrific information that is shared in the comments. Rather than re-type my thoughts from earlier, here are some C&Ps of my comments from the previous thread:

Submitted by Turd Ferguson on April 25, 2012 - 10:46am.

If anyone is willing to gamble in the casino, now would be the time. This reeks of a screwing of put sellers ahead of option expiry. The final beatdown before the reversal.

Submitted by Turd Ferguson on April 25, 2012 - 11:17am.

The summer is going to be hot and explosive, though, so anyone gambling should be sure to buy time, too.

Maybe (buy) the Oct or Dec (silver) $40s?

All I know is that today's action is bullshit. May call sellers have been forced to hedge by shorting futures. Just like the action we saw in late March prior to April gold option expiry. Recall that after dropping to 1630, price rallied sharply back toward 1700. Same shit here.

I expect silver back to 32 or even 33 relatively quickly, The Bernank notwithstanding.

Submitted by Turd Ferguson on April 25, 2012 - 11:21am.

A drop to 30 or just below is possible but I firmly believe that that is it.

Physical demand is very strong and there are literally tonnes waiting and hoping to be filled at $30.

EVERYTHING points to a bottom here. Longterm holders WILL NOT be disappointed.

Submitted by Turd Ferguson on April 25, 2012 - 11:48am.

And most should NOT (be trading).

However, this action reminds me of the day in early November 2010 when QE2 was announced. A beatdown headfake occurred that day prior to the announcement.

Again, if you are willing to risk a loss in the casino, this looks like an excellent opportunity to give it a whirl.

Obviously, I believe today's low was the bottom. Maybe there will be a retest but $30 silver is going to be a very difficult barrier for the permabears to break. I would still be looking to put on a speculative position here with money you are fully content to lose if you are wrong or if it is stolen from you. That said, if you absolutely feel compelled to trade in the casino, this would be a good time to give it a try.

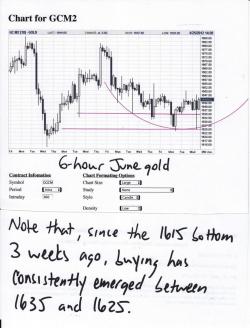

Gold is basing above what appears to be solid support between 1625 and 1635. As our pal, Winston, pointed out earlier today, physical demand is so strong and consistent here that further, sustained drops in paper price are highly unlikely. Gold will show signs of life when it trades back above 1650 and then 1660. Let's go into more detail and begin to get excited then. For now, let's just be happy to be building such a strong base from which we can, eventually, catapult forward.

Clearly, I'm excited about silver here, too. $30 silver completes the right shoulder of our massive, reverse H&S formation and Winston has informed us about incredible demand for physical silver at that level. I am nearly 100% certain that silver won't fall again much below today's lows. As it bases here, it is preparing for Battle Royale II. Of course you remember Battle Royale I at $36 in late February and the ensuing crush. Well, Battle Royale II now lies near our old nemesis of $33. What will happen next time? I can't say for sure but I'm quite certain we won't have to wait too long to find out.

Just a quick word about open interest and the next CoT. Today's OI (basis yesterday) came in at a new low of 395,389 in gold and 122,325 in silver. Recall that yesterday, price rose by about $10 so what we clearly saw was short-covering ahead of The Bernank. No doubt many of those same shorts were put back on this morning and are now, once again, waiting to be covered. While silver rose 22c yesterday, OI fell by about 400. Clearly this was a short-covering bump, too. Please allow me to emphasize this again:

Since March 15, paper silver has fallen in price by over almost $2 yet total Comex open interest has expanded by almost 15%. There is no question in my mind that this is the result of short contracts being added. Just as the EE fleeced the over-excited longs in February, they will soon fleece the over-indulgent shorts. Just be patient.

For the CoT reporting week, gold fell about $9 while shedding 3200 in OI. Silver fell $1.22 while adding about 1000 contracts. Here's why both are ultimately positive: Gold liquidity has been wrung out and now sits patiently in the sideline, waiting to return as the charts improve. The much smaller silver market has swung from speculative long excess in late Feb to speculative short excess in late April. The EE, playing both sides of the specs for profit, will soon close the trap on the foolish spec shorts.

Finally, this short video about government debt. Not much new here for the average Turdite but, since it's presented in such a brief and simple manner, perhaps you can C&P the url and email it to your friends.